COACHELLA VALLEY REAL ESTATE MARKET

Headlines day after day talk doom and gloom; inflation, rising interest rates, & some predicting a 2008 style recession and real estate market crash. We know the Headlines do more to terrify than clarify. So, we’ve been on a campaign to help bring clarity and perspective to what’s happening in the Coachella Valley Real Estate Market. Our goal is to arm you with knowledge that leads to your best decision as it relates to your real estate investments.

Let’s get started with a look back at the 2022 Coachella Valley Real Estate Market.

SALES

Single Family Home sales in 2022 were down 30% from a record high of 7,726 sales in 2021, that’s a pretty big hair-cut. La Quinta had the largest decline in sales at 41%, followed by Indian Wells down, 34%.

MARKET ACTION

69% of the sales in 2022 in the Coachella Valley Real Estate Market were below $1 million dollars, with the majority between $400,000 – $800,000. If you’re a home seller in the $800,000 range, but want to ask more so you can negotiate, these numbers indicate you’re smarter to position your home at $799,000. You’ll have a larger buyer pool looking and making offers on your home.

PRICES

Interestingly, while the number of sales in the Coachella Valley Real Estate Market were down significantly, the Valley’s average selling price for a single-family home is up 20%. Rancho Mirage and Bermuda Dunes had the largest increase in prices, 28%. Next was La Quinta and Palm Desert with a 26% increase.

Home Buyers have been sitting on the sidelines, waiting for prices to drop as sales have slowed. In a normal market it would be reasonable to think with sales down 30%, we should see an increase in inventory, an increase in time on market and a decline in prices. But that hasn’t been the case. Inventory is down 18% from 2021 and the time it takes to sell is down, 16%.

So, what’s happening? Why aren’t past patterns holding true this time? We have several factors at play.

INTEREST RATES

The biggest story of 2022 was about rising Interest Rates; those higher rates had the largest impact on sales. In two short years, rates went up 2+ points.

For a Home Buyer, the uncertainty created a wait and see attitude. But waiting has been expensive; looking at the averages, a home that was $600,000 last year had a mortgage payment of $2,155 / month. This year that house is $732,000 and the mortgage payment is $3,325. That’s a significant increase and impacts how much a Buyer can pay for a house in order to qualify for the loan.

While rates are up from last year, in the big picture, rates are low by historic comparison. To add a little perspective, current rates are back to late 2000 levels when we all thought rates were great!

RATE OF INCREASE

What’s been startling is the rapid pace of the increase. Rates were at historic and unsustainable lows as the FED lowered rates to promote business activity, while the US Treasury poured money into the economy to help us through the financial shock of the Pandemic. Now, we’re returning to a more normal real estate and mortgage environment. Buyer’s who are seeking a loan, will adjust the price range of the homes they’re looking at.

As inflation continues to pull back, Experts predict we’ll see mortgage interest rates start to level and are forecasting rates will be low 5% range by mid 2023. We’ve already started to see rates come down from their high in late 2022.

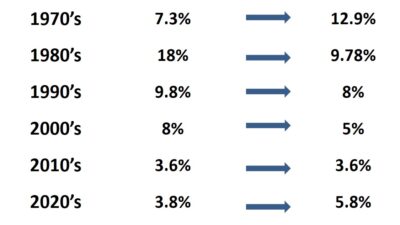

HOME PRICES VS INTEREST RATES

Understandably, Buyers are concerned about home values. Looking at the history of home values and the relationship between interest rates and home prices may help. Dave Ramsey had this great graphic that looks at the relationship between median home prices and fixed rate mortgage averages. You can see Home prices did not go down during the most extreme interest rate environment. Home prices have steadily increased, regardless of interest rates.

COACHELLA VALLEY REAL ESTATE MARKET NEW CONSTRUCTION

New construction across the country has been lagging since the 2008 financial crisis. Many Builders, caught with standing inventory they couldn’t sell, have been shy to take that leap of faith to start new projects. Locally, in the Coachella Valley Real Estate Market we have more than 20 new home projects under way here in the Valley. From entry level to high-end Custom Homes. In my informal survey of our local builders, I asked each if they’re pulling back on production due to slower sales, each said they would finish out their current project and reassess the market climate before they start breaking ground on any new projects. They all agreed sales are slower, but still moving. Those that are far enough along are hoping to finish build-out by the end of the year but admit it may extend into 2024 for completion. Some are offering Builder concessions to off-set higher interest rates. Builder sentiment for 2023, all had cautious optimism.

RENTS

Typically, our seasonal lease inventory is booked a year in advance, with very tight supply and high seasonal rates. This season, we have some inventory available, not a lot, but some – and we’ve seen some rates reduced. Whether this is because everyone who wanted to be here have purchased or it’s a reflection of the increase in investors, time will tell on this topic.

SUMMARY

Recently, I heard someone say Home Sellers think it’s 2021 and Home Buyers think it’s 2008. While neither is true, it is a dilemma that’s helped create the impasse between the two.

Home Seller’s are right; prices are holding and based on closing numbers for 2022, they’re rising, albeit at a much slower pace. Home Buyer’s are right also, there are fewer Buyer’s in the marketplace, and those few aren’t necessarily committed to buying. They’re more willing to walk away if the house, conditions and/or price isn’t exactly in line with their wish.

So, how do we bridge this gap? How do we bring these two very different views of the market together?

FOR HOME SELLERS –

Buyers are buying, but on their terms. They’re willing to pay for move in ready, well cared for properties that show well and top notch condition. But they’re not willing to over-pay. Multiple offers and over-bidding the listed price is rare in this market. Also, there’s been a sea change in style that Homes Buyers are looking for. Over the past 2-3 years; Desert earth tones have fallen out of favor with Buyers. They’re looking for light, bright and more contemporary. That means for top dollar, Sellers need to bring their home up to the new standard. Short of that, the price will need to reflect the investment a Buyer will want to make for the changes. The problem with that strategy, Buyer’s really aren’t willing to do work unless the price makes it too attractive to pass. Presentation and pricing is more important now than ever.

FOR HOME BUYERS –

Prices are not falling through the floor and market indicators say they aren’t likely to any time soon. Home Sellers are in a strong position with equity and they’re reluctant to give up that low-cost mortgage. As with Buyers, Sellers are also not necessarily committed to selling. Absent isolated cases, Sellers aren’t going to fire sale or even discount their property from fair market value.

LOOKING AHEAD

While the Coachella Valley Real Estate Market is slightly tipping away from Sellers, it’s hardly a bonanza for Buyers. We see 2023 as a continuation of last year with the number of sales leveling and price gains moderating. Interest rates aren’t going back to 2%, but we do believe the experts who say we’ll see interest rates stabilize in the low 5% range. We predict Home Buyers and Home Sellers will both get over the shock from recent market changes and become more comfortable moving on with life. Realizing we can only put life on hold for so long then we all just need to make our best decision to move on. For both Home Buyers and Home Sellers, after the decision to buy and / or sell, you’re where you want to be – in your new home at today’s prices. As rates come down, refinancing at the lower rate will make sense.

A TRUSTED RESOURCE

For a market in transition, having an experienced team working for you is more important now than ever. We have a deep understanding of this market and bring over 20 years of market knowledge and experience to assist you in negotiating your best deal whether as a Home Seller looking to capture top dollar for your home or as a Home Buyer looking for your Desert Dream Home.

Reach out to us today to find out why most of our business is repeat clients and referrals from happy clients. We like to say, “if it’s important to you, it’s important to us.” It defines who we are and the way we do business.

We want to be your first call when it’s time to buy or sell your home in the Desert. We’re here, and on standby to help, we look forward to the opportunity to discuss your real estate goals.

Give me a ring, I’m on my cell (760) 218 – 5752 or send a quick email Cathi@DesertAreaHomeFinder.com

Thank you!

Cathi Walter

Broker Associate | LUXE Director

CA DRE 01346930

Bennion Deville Homes