INFLATION, MORTGAGE RATES AND REAL ESTATE

There’s been a lot of speculation and hand wringing about high inflation, rising interest rates and the real estate market. Not surprisingly, people are concerned how it will impact real estate markets. Are we headed for a recession? Is the real estate market going to crash? Should I wait to buy a home? Should I wait to sell my home? These are just a few of the questions and concerns we’re hearing.

In an effort to understand how these external factors, impact the Real Estate market and more specifically, the Desert Real Estate Market. We look to the experts for insight and perspective.

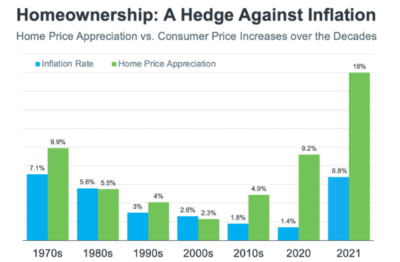

HOMEOWNERSHIP, A HEDGE AGAINST INFLATION

History shows that regardless of Inflation, Interest Rates, even 13 Presidential Elections with 10 different Presidents regardless of party affiliation, an investment in real estate has been a good return on investment.

In a recent article by David Childers, CEO of KCM, he shows the relationship between Home Price Appreciation and the Inflation Rate. With one brief exception during the financial crisis of 2008 Real Estate has been the antidote to inflation since the early 1970’s.

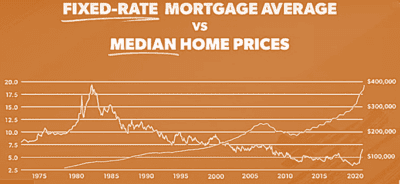

HOME PRICES AND MORTGAGE RATES – INFLATION INTEREST RATES AND REAL ESTATE

In a recent discussion, Dave Ramsey of Ramsey Solutions said, we need perspective and the way we gain perspective is to look at the historical data. As you can see in the chart below, median home prices in the US have steadily increased over the past almost 50 years. Even during the period when mortgage interest rates spiked to historic highs, median home prices steadily moved up.

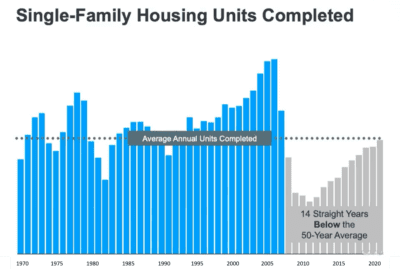

SUPPLY AND DEMAND

The Real Estate Market, like all markets, is driven by the simple principal of supply and demand , in a recent article posted on Investopedia, The forces of supply and demand work against one another until the point at which a property’s equilibrium price is reached.

ON THE SUPPLY SIDE, we’ve had fourteen straight years below the 50-year average for new construction. Creating a huge constraint on available housing.

Since 2017, some estimates show over 100,000 homes have been lost in the US due to some type of Natural Disaster. Those displaced families were unexpectedly forced into the home buyer market. A double impact on the housing market; the loss of that inventory while at the same time, creating additional demand.

Add to that, many would be move up home sellers, haven’t moved up. They find themselves in a conundrum saying, I need someplace to live, and if I sell at this high price – then I become a buyer at these high prices.

Additionally, homeowners who refinanced into historic low mortgage rates are reluctant to give up those low payments for higher priced homes, higher interest rates and higher property taxes. They’ve been satisfied to wait it out.

Combined, these factors have played a huge role in the inventory shortage we’ve experienced. No matter how you slice it, we don’t have enough homes available to meet demand, and that can’t be fixed over-night.

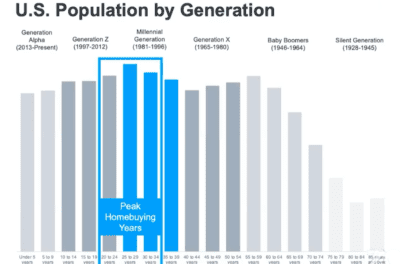

ON THE DEMAND SIDE, the largest segment of the population, Millennials are in their prime home buying years. The pandemic brought these previous renters, into the home buying market as they realize they want to own a piece of the American Dream. This group is also part of the work from home trend that has swept across the nation. They can now buy a home virtually anywhere and still work full time because they’re commuting virtually.

COVID, CRIME, TAXES AND THE GREAT US MIGRATION

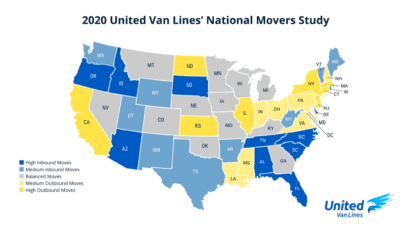

Whether it was trying to get out of crowded cities ravaged by the pandemic and crime, find a school that would teach their kids in person, or high taxes; Americans have been on the move in greater numbers than any time since…probably the dust bowl. Out of necessity, technology has allowed businesses and their employees to set up work from anywhere. This United Van Lines “National Movers Study” shows, people are moving out of these areas and into cities where they can feel safe and have more space.

While CA has seen a large outflow of residents moving to other states, the Coachella Valley has enjoyed an influx of homebuyers, moving from surrounding Urban areas in search of a high-quality lifestyle and lower home prices, albeit a relative term.

HOW DOES ANY OF THIS RELATE TO THE COACHELLA VALLEY?

Like most of the country, the Coachella Valley has benefited from the aftermath of the pandemic and the work from home trend. In addition to more people wanting to live here, the average age in the valley is trending younger and they’re still working. We’ve seen an increase in new business start-up’s, new home developments are popping up across the Valley. New resorts and activities, other than golf, for younger generations. The Coachella Valley isn’t just for snowbird’s or the well-heeled retired anymore.

Once airlines were allowed to fly again in June 2020, after the March stay at home order was lifted, many people got up and moved out of big cities and quickly realized they could afford to buy a terrific home here in the Coachella Valley for less than the rent they were paying. They could live a great lifestyle and keep their job, even if the office was hours away.

Once that trend started to accelerate, home sales increased almost exponentially, from the low in March 2020 to July 2020 there was an 85% increase in the number of sales in the Coachella Valley, and home prices followed.

Existing homeowners in other areas of CA, some close to retirement and others still working but looking for a simpler way of life, knew it was the right time to make the move. They were able to sell their homes for record profits, and with cash in hand we saw an influx of ready to go, all cash homebuyers competing for the chance to buy a home here in the Desert. Multiple offers, each higher than the previous, pushed average home prices up 27% from July 2021 to July 2022.

WHERE DO WE GO FROM HERE WITH INFLATION INTERES RATES AND REAL ESTATE

In an effort to slow inflation, the US Federal Reserve raised the Fed Funds rate and is expected raise further throughout the rest of this year. The impact on the Coachella Valley Real Estate Market has been mixed. From July 2021 the number of sales has pulled back about 18% , while prices are up 27%. Homes are selling at 99% of asking price and the time on market is down 33%.

Inventory is up from last year, the first meaningful increase we’ve seen in the last three years. The absorption rate is 28% for sold properties indicating we’re moving into a more balanced and sustainable market.

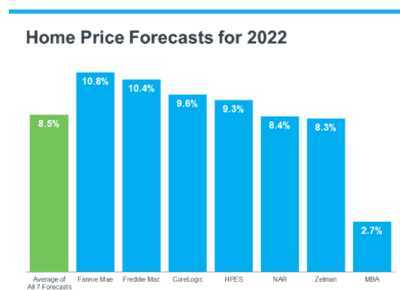

By the end of 2022 home prices are expected to increase again. Seven major experts in real estate analysis show an average of 8.5% increase for 2022.

Sources: *Fannie Mae, Freddie Mac, CoreLogic, HPES, NAR, Zelman, MBA

Selma Hepp, Deputy Chief Economist at CoreLogic, explains why the housing market will see deceleration, but not depreciation, in prices: “The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

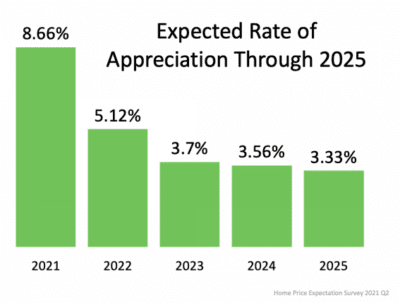

In more good news for homeowners, the most recent Home Price Expectations Survey – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists – forecasts home prices will continue appreciating over the next five years, adding to the record amount of equity homeowners have already gained over the past year. Below are the expected year-over-year rates of home price appreciation from the report:

SUMMARY

When it comes to Inflation, Interest Rates and Real Estate – Whether you’re a home buyer or a home seller, you need to know what’s happening in the housing market so you can make the best-informed decision as possible.

For current Homeowners, your home’s value is not projected to fall, but waiting to sell and make another purchase does mean your next home could cost more as home prices continue to appreciate.

For Home Buyers, if you’re ready to make your move, it may make sense to do it now before prices climb further. Be confident knowing that price appreciation will help grow the value of your investment.

If you would a copy of our Desert Home Seller or Desert Home Buyer Guide, drop me a line.

For more information about current market conditions and if now is the right time for you to make your move, give me a ring. I’m on my cell and on standby to help.