ANNUAL MARKET REVIEW FOR 2023

At the start of each year, we take the time to do a deep dive into the local Coachella Valley Real Estate Market. We look back at performance metrics and compare those to the year prior. We’re looking for patterns and developing trends. Our goal is to provide insight and clarity into the market dynamics. We understand that well-informed decisions are the best decisions when it comes to your real estate investments.

OVERVIEW OF REAL ESTATE IN THE COACHELLA VALLEY

Persistent fears of a recession hitting the residential real estate markets throughout 2023, proved unfounded. Despite doom and gloom headlines, rising interest rates, and slower sales, the real estate market kept ticking along nationwide, including our local Desert Market.

While the parabolic surge in sales and prices we experienced in 2021 and 2022 has subsided, our market now has a more tempered growth pattern. When we compare 2023 to 2022, we see a decline in the number of sales throughout the valley. However, property prices remained relatively stable, with a slight decrease of less than 1%.

As we entered the new year, our inventory stood at 1,399 Single Family Homes for Sale, compared to 1,227 in January 2022. This approximately 14% increase aligns with local seasonal patterns.

After mortgage rates topped 8% in October 2023, rates started to fall sharply to close out the year. Rates currently sit at about 6.29% APR, spawning new Home Buyer interest and activity. Lower mortgage rates and leveling of home prices have also sparked interest from potential Home Sellers who have felt trapped for the past couple of years, unable to find a suitable replacement home they could afford.

SALES

Valley home sales in 2023 were down 19% from 2022. Cathedral City had the biggest decline, -26%, followed by Indian Wells, with a – 21% decline in sales.

MARKET ACTION

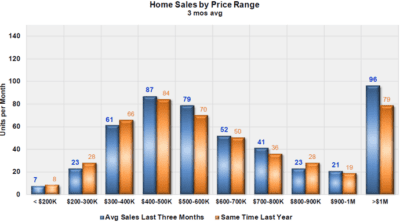

As published by Market Watch LLC, this Market Action by Price Band for Coachella Valley Real Estate shows the 3-month average to account for seasonal swings, you can see across all price categories, the monthly number of sales in 2023 was similar to 2022.

This is a positive indicator showing we don’t have a big imbalance in any single price range. The stand-out was in the $1m+ price range, averaging 96 sales / month. Up about 22% from last year. This increase is likely more influenced by the fact that with rising home prices over the past three years, we now have more homes priced at $1m or above. We also saw a slight uptick in the $400,000 – $500,000 range averaging 87 sales / month.

MARKET action index by price band

COACHELLA VALLEY REAL ESTATE PRICES

Interestingly, even though the number of sales declined in 2023, the average selling price for single-family homes in Coachella Valley Real Estate remained remarkably steady, with a valley-wide decrease of less than 1%. Notably, Indian Wells and Palm Desert experienced the most significant price pullback, both down by 11%. In contrast, La Quinta saw a 4% increase in its average selling price compared to 2022. Largely due to three monster sales in The Madison, one at $31m and two at $21m.

INTEREST RATES

The worst appears to be over; Mortgage Interest Rates started to decline in the 4th Quarter of 2023. Currently, at 6.29% APR, we point out that despite this decline, rates are still higher than the previous year of 5.34% APR.

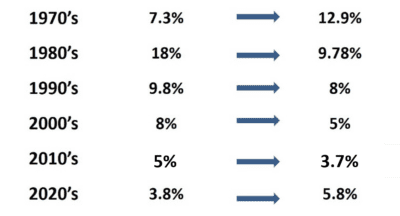

MORTGAGE INTEREST RATE HISTORY – BY THE DECADE

Many insiders were looking for interest rates to be in the mid to high 5% range by the 2nd quarter of 2023. However, persistent inflation kept rates higher for longer. Now, with inflation moving in the right direction, those experts are predicting several cuts in the FED Funds rate in 2024 which will have a positive impact on mortgage rates and Home Buying.

THE INVENTORY DILEMMA

Homeowners who refinanced at the bottom of the mortgage market found themselves in a quandary, often referred to as “Golden Handcuffs”, they’ve been stuck. Despite their desire to move up, downsize, or just make a change, home sellers were faced with both higher mortgage rates and higher home prices. With interest rates trending lower, we should start to see more Homeowners ready to move on with their lives.

HOME PRICES VS INTEREST RATES

It’s natural for Home Buyers to be concerned about the future value of Coachella Valley Real Estate and how that might impact their purchase. To gain a better understanding, let’s examine the historical relationship between home values and interest rates, as beautifully illustrated by Dave Ramsey. This graphic demonstrates that even in the most extreme interest rate environments, home prices remained resilient. In fact, median home prices have shown a consistent upward trend, seemingly unaffected by fluctuations in interest rates.

FOREIGN BUYERS

We had a few more Canadian Buyers in 2023 and expect that trend to carry through in 2024. However, the strong American Dollar compared to other currencies such as the Canadian dollar, continues to impact the demographics of our Home Buyers. In years past, the Canadian Buyer represented as much as 31% of our sales – today, the buyer is more likely to be domestic coming from the States and most likely, from our drive-markets such as Orange County, Los Angeles, San Diego, and San Francisco with the most interest in buying Coachella Valley Real Estate.

NEW CONSTRUCTION

New construction ramped up considerably in 2023, with several new home developments popping up across the valley. Currently, there are 102 new, (2023 or newer) homes on the market. The average listed price is $2,269,000.

238 new homes sold in 2023, (an average of 20 sales / month) those homes sold at an average of $1,228,000. Home Sellers cannot ignore this growing segment of the market, as the allure of “new” is a compelling story for Home Buyers.

RENTS

Typically, our seasonal lease inventory is booked a year in advance, with very tight supply and high seasonal rates. This season we have some inventory available, and we’ve seen some rates reduced, largely in Short Term Rentals in the Palm Springs area. Whether this is because everyone who wanted to be here has already purchased, or if this trend reflects over-saturation by investors, time will tell on this topic.

WHAT’S AHEAD FOR 2024?

Influenced by rising interest rates, Home Buyers were more “discerning” in 2023, they were willing to sit back and wait; the decline in the number of sales reflects that. With the 2024 season now in full swing, we’re seeing a notable increase in Buyer activity. We’ve seen some sporadic price reductions; and home sellers unwilling to align their pricing with the current environment are sitting on the market, with some not selling. In 2022, homes were selling at 100% or more of the asking price. Today, Sellers are negotiating on price. Valley-wide, the average sale-to-list price ratio is about 98% of the asking price. We survey our partners in Escrow, Title, and Mortgage Lenders, each month to understand what they’re seeing, we’re looking for trends in market direction. All of our partners have seen an uptick in Buyer activity since December.

SUMMARY

For Home Sellers – Buyers are buying, but on their terms. They’re willing to pay for move-in ready properties that show well and top-notch condition. But they are not willing to over-pay. Conditions that created multiple offers and over-bidding are over. In addition, Buyers are looking for more current design trends. The desert earth tones have fallen out of favor. Buyers are looking for light, bright, and a more contemporary look. That means for top dollar, Home Sellers need to bring their properties up to the new standard. Short of that, the price will need to reflect the investment a Buyer will need to make for the changes. The problem with that strategy is that buyers are generally not willing to do work unless the price makes it too good to pass up and even then, they’re reluctant if they don’t have resources in place to do the work. Presentation and pricing are more important now than ever.

For Home Buyers – The Market is more balanced as we enter 2024, but still favors Home Sellers. Prices are not falling through the floor and market indicators say they aren’t likely to any time soon. Home Sellers are in a strong equity position and absent anecdotal stories of “needing to sell” they can afford to wait.

For both Home Buyers and Home Sellers, understanding “fair market value” for the neighborhood is essential to negotiating your best deal and successfully closing.

LOOKING FORWARD

While the market has slightly tipped away from Sellers, it’s still in the “Seller Advantage” category, and not a price bonanza for Buyers. For 2024, we see a more balanced market.

As interest rates continue to decline, Home Buyers are becoming more comfortable with rates in the 5 – 6% range. As Home Sellers come to terms with prices that have leveled and get more comfortable with the idea of moving, the tight inventory – a condition that has plagued us for the past 3+ years, will start to loosen up.

Both lower interest rates and more inventory will open the door for more Home Buyers and Home Sellers to start making their plans to move. We predict Home Buyers and Home Sellers will both get over the shock from recent market changes and become more comfortable moving on with life.

A TRUSTED RESOURCE

For a market in transition, having an experienced team working for you is more important now than ever. We have a deep understanding of this market and bring over 20 years of market knowledge and experience to assist you in negotiating your best deal whether as a Home Seller looking to capture top dollar for your home or as a Home Buyer looking for your Desert Dream Home.

Reach out to us today to find out why most of our business is repeat clients and referrals from happy clients. We like to say, “if it’s important to you, it’s important to us.” It defines who we are and the way we do business.

We want to be your first call when it’s time to buy or sell your home in the Desert. We’re here, and on standby to help, we look forward to the opportunity to discuss your real estate goals.

We hope you found our 2023 Annual Market Review informative and useful.

It’s always our goal to provide quality market information as you consider your options for Real Estate in the Desert.

Whether you’re thinking about Selling and Buying Your Next Desert Home, or Buying your First Desert Getaway, we work hard to be the best real estate agent choice in Palm Desert and the Coachella Valley. We have a deep understanding of the Desert Real Estate Market and Knowledge to Share.

Let’s talk about How Your Real Estate Goals Fit in this Market.