Rising Home Prices, Multiple Offers, and Limited Inventory. Home Buyers are Asking, “Are we in a Housing Bubble and is Now a Good Time to Buy?

We say No We’re Not in a Housing Bubble and Yes, It is a Good Time to Buy ….. and Here’s why

ARE WE IN A HOUSING BUBBLE?

1) Houses Aren’t Unaffordable like they were during the Housing Boom.

Fifteen years ago, home prices were high, wages were low and mortgage rates were over 6%.

In 2007 the average priced home took 34% of the average wage earners gross income to pay the mortgage. Today, it’s 26%. Prices are still high, but wages have increased and mortgage rates, despite the recent increase, are still below 6%.

2) Mortgage Standards Are Nothing Like They Were Leading Up to the Financial Crisis Between 2007-2011

During the Housing Bubble (2003-2007) Mortgage Lenders lowered lending standards to include borrowers with Credit Scores below 620. That raised the percent of subprime loans from previous standards of 8% to 20% and as much as 90% in some parts of the US. Fueling speculation buying; Investors represented 35% of home sales during that period.

3) Few Foreclosures – Homeowners today are equity rich, not tapped out as they were during the crisis.

In the run-up to the housing bubble, some homeowners were using their homes as an ATM, immediately withdrawing equity. When values started to fall, it created a negative equity situation (the amount owed was greater than the value of the home) and a domino effect started from there. Some decided to walk away from their homes leading to a rash of distressed property listings that were short-sale or foreclosure. These homes sold at huge discounts, lowering the value of homes in the area.

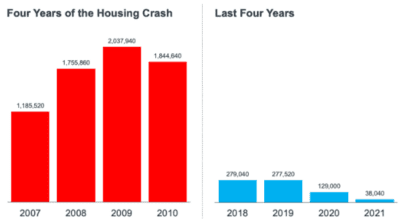

4) No Excess Inventory – We Have a Shortage.

The amount of housing inventory needed to sustain a normal real estate market is approximately six months. More than that is a surplus and will cause prices to depreciate. Less than six months is a shortage and leads to continued price appreciation.

A Good Time to Buy?

5) The Work from Home, (WFH) trend will continue –

Going to the Office has forever changed since the Pandemic. Today the office is more of a hybrid. People are choosing to work, at least part of the week, from home. This trend has opened ancillary markets creating an increase in demand, which continues today despite exiting the Pandemic crisis. The pressure this trend created on both inventories and home prices will continue pushing home prices up.

6) Interest rates will continue to rise –

Fed Chair Jerome Powell, indicated they will increase the Fed Funds rate at least six times in 2022. That means interest rates for home mortgages will notch up each time, increasing the cost of a mortgage and reducing how much house a Home Buyer can afford.

7) Home Prices Continue to Rise –

Unless we see an all-out Home Selling Bonanza, prices will continue to increase due to high Buyer demand and low inventory after eight years of below average new home construction.

Summary –

The conditions that lead to the Housing Bubble of 2003 – 2007 and subsequent financial crisis of 2007 – 2011 don’t exist today. Borrowers are in better financial condition and Banks have lending guidelines that promote a healthy lending environment.

Millennials, the largest homebuying generation in the market, represent 37% of Homebuyers and they want to own a home. They’re setting the standards for Work from Home and what that will look like in the future. Experts don’t see this trend going away any time soon.

Get Your Free Copy of Our Desert Home Buyer Guide Now

Despite an increase in new construction over the past year; we had more than eight years where Home Builders weren’t building enough homes to meet demand following the financial crises. Pile on to that, increased Buyer Demand due to the Pandemic and severe supply chain shortages and production delays. We expect to see a tight housing inventory for the foreseeable future.

If you’re worried that we’re headed down the same path as 2003-2007, the experts and the data say we aren’t and now is an excellent time to secure your dream of homeownership. Whether it’s moving up to a larger home or downsizing because you want less work.

What Does the Real Estate Market Look Like for the Coachella Valley?

If you would like more information about buying a home in the Desert, give us a ring – we’re happy to help.