YOUR BEST PERFORMING INVESTMENT

For most of us, our home is the largest asset we own and the best performing investment. In this article we discuss Home Equity vs Home Value. What’s the difference and how your Home Equity is Working For You.

EQUITY DEFINED

Home Equity is defined as; the difference between what your home is worth and what is owed. At any point in time until the sale, it’s an estimate, – because value is subjective until the home actually sells. If a home seller thinks their home is worth more than what a buyer is willing to pay, the estimated equity is too high. If a buyer is willing to pay more than the home seller believes the home is worth, then the estimated equity in this case would have been too low.

MEASURING HOME EQUITY

Home Equity becomes more objective after a home sells; the speculation and conjecture is over because actual money and title have been exchanged. Value is established when a home seller and a home buyer have negotiated the final selling price.

Equity, as defined above is more accurately referred to as Gross Equity. After expenses, the mortgage and liens are deducted from the sale price, the proceeds are referred to as Net Equity.

RATE OF APPRECIATION

The news frequently reports national statistics on appreciation for the month, year, or even longer. To understand better how your property has appreciated; using local appreciation statistics will be more representative.

Market Watch LLC reports “The median existing detached home price in the Coachella Valley was $724,523 in April 2024, up 6.6% year over year. That number represents valley-wide median, which gives you an overall idea of your homes appreciation and how Home Equity Working For You. Each situation will be different as we get more specific looking at your property.

To see what your homes rate of appreciation is, take the increase in value of your home over a one-year period, then divide that by the starting value. This will give you the rate of appreciation for that year.

LOW INVENTORY / APPRECIATION

Persistent low inventory has been the main driver behind price appreciation, which has increased homeowner equity. On a national level, there are roughly 80 million homeowners in the United States holding over $17 Trillion in home equity.

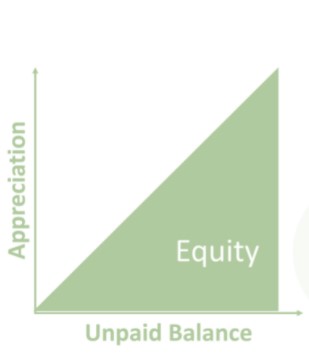

If you have a mortgage on your home – while your home is appreciating, the unpaid balance is declining. With each payment you make, an increasing portion is applied to the principal, decreasing the unpaid balance and increasing your home equity.

WORKING IN CONCERT

There are two dynamics at work; appreciation and the unpaid balance. They work in concert to make Homeowner’s equity grow. Every month the equity in your home grows because it’s worth more due to appreciation, while the unpaid balance is shrinking because of amortization.

You’ve been hearing a lot about home equity lately for one very big reason; there’s a lot more of it. As home prices boomed throughout the pandemic, many homeowners enjoyed some massive appreciation in the size and worth of their ownership stake in their properties, an example of your home equity is working for you

As of early 2024, the average homeowner held $299,000 in equity, that’s up significantly from $182,000 at the beginning of the pandemic.

IS A BOOM OR BUST AROUND THE CORNER

The number of “under-water” properties represent about 2.1% of all residential mortgages. Nationally, that number decreased 15% year over year in Q4 of 2023. The aggregate value of that negative equity was down $12.4 billion year over year.

There are a lot of home buyers sitting on the side-lines waiting. As mortgage interest rates start to come down, we’ll see more buyer activity which will quickly absorb the increase in inventory we’ve seen. What always remains true, a quality home that is well presented, in a good location will always capture the attention of home buyers.

We work closely with Homeowners from the day they buy their home to the day they decide to sell, and all the times between. Our goal is to make our clients homeownership experience the best it can be.

If you’re on the fence whether you should take advantage of this market now or wait – contact us today, let’s talk about how your real estate goals fit in this market.