Buying or Selling a Home with Solar

In the third Quarter of 2023, there were 210,000 new soar systems installed on homes across the U.S. As solar systems have become more efficient and less expensive, they’ve become more popular with homeowners.

There are unique benefits and challenges when buying or selling a home with solar that you want to know about

BENEFITS

- Solar is a hedge against rising utility costs for electricity

Electricity prices have soared over the past two decades, averaging year over year increases of about 11%. - Solar is a renewable energy source

The suns power won’t deplete as we use it to make solar electricity

- Energy Independence

As a homeowner you’re creating and using your own energy, instead of relying on the electrical grid. With a battery back up system, you’re even less dependent on the grid, you’re producing and storing the power for your own use during off hours of production.

- Great financial investment

Solar panels can pay for themselves in a few years, the average pay back time is about 10 years.

THE CHALLENGES

- High Initial Investment

Even with the benefits of lower electric bills, there’s still a hefty up front cost

- Dependent on Weather

Here in the Desert, Solar makes perfect sense. We average 350 days of sunshine a year. In areas that are rainy, have fog, or often have cloud cover – solar may not make sense.

- Difficult to Take With You if You Move

Once a Solar System is installed, it’s nearly impossible to transport. Theoretically, it is possible to transfer a solar system, but not advised.

How do you determine the value a solar system adds when buying or selling a home with solar

In this Lawrence Berkeley National Labs study, (a research lab affiliated with the DOE), they found homes with solar sell for 4.1% more than homes without solar systems. The study found that home buyers are willing to pay a premium for systems that are owned.

The same is not true for leased solar systems. The home value premium only applies to homes with “host-owned” PV,(aka photo voltaic systems). In other words, if you own your solar system vs leasing the panels from a solar company.

The study also found, just because you spend more on a larger PV system, the premium on the resale value may not scale to match the investment. Smaller systems for more modest homes return a higher margin on the investment when the home hits the real estate market.

When weighing the cost vs the benefit – the determining factor will be the ROI, how long it takes to recoup the hefty up-front investment. Through energy savings, tax credits, and the potential increase in your home’s value at time of sale.

There are many factors that influence a solar system’s true value, including the age, size, and power output of the system. No two solar systems are alike, which is why appraisers need to value each system independently.

One of the biggest gotchas of buying or selling a home with a rooftop solar system has to do with who owns the system, and that depends how the system was purchased.

There are a few different ways you can purchase your solar system: Cash Purchase, Loan, Lease or Power Purchase Agreement.

CASH PURCHASE

Homeowners who purchase a solar system outright with cash, own the system. When you’re buying or selling a home with solar this is the simplest scenario in a real estate transaction. A solar system purchased outright is considered “real property,” in real estate parlance, or a fixture of the home, and can therefore be appraised as part of the home’s value.

LOAN

PACE programs, (Property Assessed Clean Entergy) provide a unique way for homeowners to finance energy efficient improvements such as solar through their property taxes. The PACE contract is a lien placed on your home until the contract is paid in full. The contract amount is added to your property tax assessment and paid with your property taxes. These loans are expensive and difficult to cancel. There is risk and many things you should know about the PACE loan ahead of time.

A solar loan that has been paid in full, is the same as a system that was purchased with cash. Once the loan is paid, the homeowner now owns the solar system and the system will convey with the house.

If, however, the homeowner is still making payments toward a loan, ownership will depend on the contract the homeowner signed with the lender. Most lenders allow the homeowner to claim ownership while they make payments. These systems can be appraised as part of the home’s value.

It’s also worth mentioning that sellers are on the hook to pay off any loan tied to a property prior to selling and Solar is no different. The Homeowner is ultimately responsible for paying off their loan obligation either as part of the sale, or through other means if the buyer is not willing to take over the loan.

This can be a sticking point between the Home Seller and Home Buyer. Maybe the panels are several years old and not producing like a new system would and the Buyer doesn’t want to pay extra for the system. These are negotiating points where the final selling price of the home may come into play during the negotiation.

Whether you’re buying or selling a home with solar, you need to know that Buyers who are willing to take over the loan on the solar energy system will need to qualify for both the home mortgage and the solar loan, this can affect the Buyer’s debt-to-income ratio.

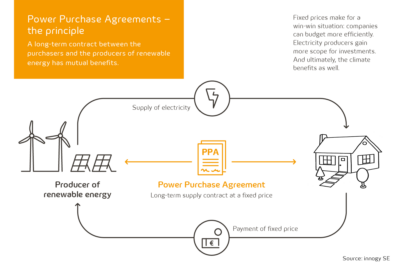

Power Purchase Agreement, (PPA) / Lease

Under a Power Purchase Agreement or Lease, the homeowner pays for the right to use the system for a specified period of time, but does not actually own the system. The system is owned by the solar provider, who typically places a UCC-1 Filing against the system. Systems financed in this way are owned by a third party (not the homeowner) and cannot contribute to the appraised value of the property.

Sellers with a solar system obtained through a Power Purchase Agreement, have a few options at time of sale; they can remove the system and install it on their new home, transfer the PPA, or lease to the new Home owner, or “buyout” their contract. The specifics vary by solar provider, so be sure to read your contract. It is most common for the new Buyer to take over the PPA or lease.

Buyers looking to purchase a property with either of these types of agreements should obtain a copy of the solar contract tied to the property and decide if they are willing to take the contract. This process may add to the timeline, but may be worth the effort. Power Purchase Agreements and solar leases are a way to take advantage of the benefits of solar with little or no up-front costs. The rates are typically lower and fixed for a specified term.

As a Home Buyer purchasing a home with a solar system, have a solar inspection done to confirm all panels are working properly and they’re producing according to the solar providers table of production. A table that projects out what the panels should be producing in 1, 5, 10 years etc.

BRINGING IT ALL TOGETHER

Buying or Selling a Home with Solar Panels – Tips for Buyers

- If buying a home with a solar system is high on your wish list, make sure your agent knows that.

- Work with agents, lenders, and title companies familiar with rooftop solar.

- Ask your agent or title company to check if a UCC-1 Filing (lien) has been placed on the system. If there is, you will need to work with your agent, title company, solar provider, and the property owner to determine how you will negotiate the UCC-1 Filing as part of the deal.

- If the system is tied to a Power Purchase Agreement or a lease, make certain you understand the risks and obligations of the contract before taking it over. You can also request the system be removed by the seller as part of the deal, assuming the seller is in a position to do so.

- If the seller is still making payments on the loan for the solar energy system, work with your agent to decide if you will take over the loan or ask the seller to pay off the loan as part of the deal. Remember, if you intend to take over the loan, you must qualify for both the solar loan and your mortgage.

- Ensure the appraiser accurately accounts for the value of the system. The appraisal validates the system’s value should you need to sell the property in the near future.

- Allow extra time in your purchase contract for the closing date. There can be a lot of moving parts when trying to completely understand the details, negotiate who will pay, etc.

Buying or Selling a Home with Solar Panels – Tips for Sellers

- Work with agents, lenders, and title companies familiar with rooftop solar.

- Get a jump start on the process, collect all of your system’s documentation together, along with 4 – 6 months of your most recent electric bills, and share those with your agent.

- If you acquired your solar system through a Power Purchase Agreement, a Lease, or through a Loan; check to see if there is a UCC-1 Filing placed on the system. If there is, work with your agent, title company, solar provider, and the buyer to determine the best way to negotiate the UCC-1 Filing as part of the deal. Rarely, but possibly, the solar provider or finance company may be willing to provide a “subordination agreement”. Taking 2nd position behind a 1st mortgage, if the buyer is willing to take over the contract. This would be an exception not the rule.

- If you’re still under contract with a Power Purchase Agreement, or Lease, or if you are still making loan payments be prepared to buy out your contract if the buyer is not willing to take ownership of the contract. If the market is strong, you may be able to adjust your asking price to account for the added expense or search for a buyer willing to take the contract.

- Ensure the appraiser accurately accounts for the value of the system. Remember, $0 valuations must be supported with sufficient evidence.

- Chances are, potential buyers aren’t looking at your house just because of the solar panels and people unfamiliar with solar panels won’t know about the added value, so it’s important for you and your agent to explain this value. The appraisal can help with that, but a knowledgeable real estate agent will be an important part of this. Be prepared to share past electric bills to demonstrate the savings you enjoy as a result of your solar energy system.

Final Thoughts

Whether you’re buying or selling a home with solar it’s generally a sound investment; If you plan to live in your home for the duration of the warranty, you can expect a grid tie-in system to pay for itself 2-3 times over with tax breaks and energy savings.

Even if you decide to move before the warranty is up, you still come out ahead. The value of the system can translate into a higher sale price when your home hits the market.

If you’re interested in buying a home with solar, and not sure what the price premium actually is, give us a ring we’re happy to help.