What is a 1031 Exchange, and can it work for you?

The 1031 Exchange for Real Estate Investors; under IRC Section 1031 allows an investor to sell a property, reinvest the proceeds in a new property, and defer capital gains taxes.

BENEFITS OF THE 1031 EXCHANGE –

Whether an investor’s property is owned free and clear or encumbered by a loan, the benefits of a tax deferred exchange can be significant. The tax dollars saved by doing an exchange can be used to buy additional investment property.

An investor who uses the 1031 Exchange, is able to defer the capital gains tax and buy a replacement property worth more than an investor who simply sells and reinvests with after tax dollars.

1031 Exchange for real estate investors provides one of the best tax strategies for preserving the value of an investment portfolio. By using an exchange, the investor is able to defer the recognition of capital gain taxes that would otherwise be due with the sale of the investment property. To qualify as an exchange the relinquished and replacement properties must be qualified, “like-kind” properties and the transaction must be structured as an exchange.

OTHER NON TAX BENEFITS OF THE 1031 EXCHANGE FOR REAL ESTATE INVESTORS –

In addition to deferring the capital gains tax, tax deferred exchanges provide the investor with a wide range of non-tax opportunities that may suit an investor’s portfolio

- Reposition assets

- Change property types

- Increase leverage

- Increase depreciation deduction

- Reduce management obligations

- Provide for estate and retirement planning

- Allow for relocation

- Improve cash flow

- Achieve property consolidation or diversification

- Eliminate or create joint ownership

THE EXCHANGE PROCESS

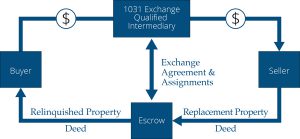

For the Real Estate Investor using the 1031 Exchange involves three parties: the investor (exchanger), party doing the exchange. The buyer who is buying the exchanger’s old (relinquished) property. And the seller who is selling the exchanger a new (replacement) property. To create the exchange of assets and to obtain the benefit of the “Safe Harbor” protections of the tax code, it is wise to employ an Exchange Accommodator, or Exchange Facilitator. This qualified intermediary becomes a fourth party principal in both simultaneous and delayed exchanges.

Steps for completing an exchange are relatively simple with a qualified intermediary:

- The exchanger signs a contract to sell a relinquished property to the buyer.

- Exchanger enters into an exchange agreement with a Qualified Intermediary and assigns rights in the sale contract to the intermediary, including the right to receive the exchange funds.

- At closing of the relinquished property, the exchange funds are wired to the intermediary and the intermediary instructs the settlement officer to transfer the deed directly from the exchanger to the buyer.

- Unless the exchanger can acquire all replacement property (s) within the first 45 days from the close of the relinquished property, the exchanger must identify possible replacement properties in writing to the intermediary within the 45 day identification period.

- The exchanger has a maximum of 180 days in the exchange period to acquire all replacement property.

- The exchanger signs a contract to buy the replacement property with a seller and the exchanger assigns the exchanger’s rights in the purchase contract to the intermediary.

- At closing of the replacement property, the intermediary wires the exchange funds to complete the exchange and the intermediary instructs the settlement officer to transfer the deed directly from the seller to the exchanger.

A FEW EXCHANGE REQUIREMENTS

A general rule of thumb for Real Estate Investors who want to use the 1031 Exchange, the investor should:

- Consult with their trusted financial advisor and intermediary

- Buy a property of equal or greater value, (net sales price).

- Reinvest all of the net equity in replacement property

- Obtain equal or greater debt on replacement property.

*Exceptions: A reduction in debt can be offset with additional cash from exchanger, but increasing debt cannot offset a reduction in exchange equity.

We created a series dedicated to learning more about the 1031 exchange; What is Like-Kind Property, Boot, Reverse and Forward Exchanges, Timelines and more. Email me today Cathi(at)DesertAreaHomeFinder(dotted)comand we’ll send you this informative series.

THE NEXT STEP

If you own an investment property, and you’re thinking about repositioning your assets for more cash flow or less management headaches, we can help. We’ve assembled a team of top professionals with extensive experience in local, interstate and intrastate exchanges, we’re on standby to help you with the sale, purchase and exchange process.

Give me a call or send me an email, let’s talk about what’s possible for your situation.

See Investment Properties for Income For Sale in the Desert

Cathi Walter

Broker Associate | LUXE Director

Cathi(at)DesertAreaHomeFinder(dotted)com

760.218.5752